Canadian investors acquired $14.9 billion of foreign securities in August, the largest investment since April 2022. Meanwhile, non-resident investors reduced their exposure to Canadian securities by $8.5 billion, the first divestment since March 2023. As a result, international transactions in securities generated a net outflow of funds of $23.4 billion from the Canadian economy in August.

Canadian investment in foreign shares reached the highest level since April 2022

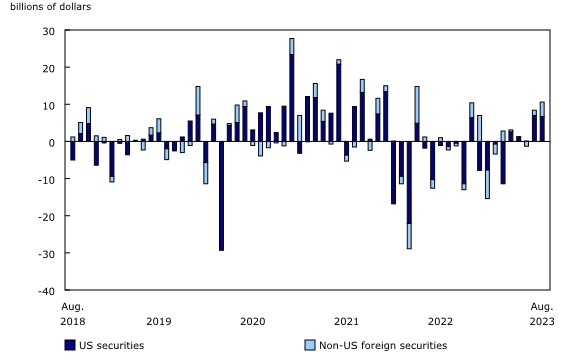

Canadian investors acquired $14.9 billion of foreign securities in August 2023, led by purchases of foreign shares and, to a lesser extent, US bonds.

The investment in foreign shares totalled $10.6 billion, the largest investment since April 2022. In August 2023, investors targeted both US (+$6.7 billion) and non-US (+$3.9 billion) foreign shares. Large-capitalization technology shares led the former, and the latter focused on shares of Asian and European markets. Major world equity markets declined in August.

In addition, Canadian investors added $3.7 billion of US bonds to their portfolios in August, mainly instruments issued by the US government and its agencies. In August, US long-term interest rates reached the highest level since December 2007.

The first foreign divestment in Canadian securities in five months

Foreign investors reduced their exposure to Canadian securities by $8.5 billion in August 2023 after four months of strong investment. The activity in August was attributable to divestments in Canadian shares and federal government bonds.

Non-resident investors reduced their holdings of Canadian shares by $5.8 billion in August for a total divestment of $40.5 billion so far in 2023. In comparison, the foreign divestment was $3.5 billion over the same period in 2022. The divestment in August 2023 was widespread across all industries except for the banking industry and the trade and transportation industry.

At the same time, foreign holdings of Canadian debt securities were down by $2.7 billion in August, following four months of strong investment totalling $70.4 billion. The activity in August was led by retirements of federal government bonds (-$6.7 billion), which were moderated by a $4.3 billion investment in federal government paper. Meanwhile, net new issuances abroad by Canadian private corporations reached a nine-month low.

Note to readers

The data series on international transactions in securities covers portfolio transactions in equity and investment fund shares, bonds and money market instruments for both Canadian and foreign issues. This activity excludes transactions in equity and debt instruments between affiliated enterprises. These are classified as foreign direct investment in international accounts.

Equity and investment fund shares include common and preferred equities, as well as units or shares of investment funds. For the sake of brevity, the terms “shares” and “equity and investment fund shares” have the same meaning.

Debt securities include bonds and money market instruments.

Bonds have an original term to maturity of more than one year.

Money market instruments have an original term to maturity of one year or less.

Government of Canada paper includes Treasury bills and US-dollar Canada bills.

All values in this release are net transactions unless otherwise stated.