Construction, whether it be commercial or residential or both, is usually correlated with strong economic growth and GDP numbers and the corresponding increase in Foreign Direct Investment(FDI), you would be right to assume that there would be an abundance of property and residential home construction taking place. That doesn’t seem to be the case. Investment in residential construction declined for the fourth straight month, falling 4.5% to $12.1 billion in June. Investment in non-residential construction edged down 0.2% to $5.9 billion. Overall, investment in building construction fell 3.1% to $18.0 billion in June.

After adjusting for inflation (2012=100), investment in building construction decreased by 3.4% to $10.3 billion.

The residential sector continues to fall

Residential construction declined for the fourth consecutive month, falling 4.5% to $12.1 billion in June. Ontario (-5.8% to $5.1 billion) accounted for most of the drop.

Single-family home construction fell 5.7% to $6.2 billion in June, with declines seen in eight provinces.

Multi-unit construction declined for the eighth straight month, falling 3.1% to $5.9 billion in June, the lowest level since September 2021.

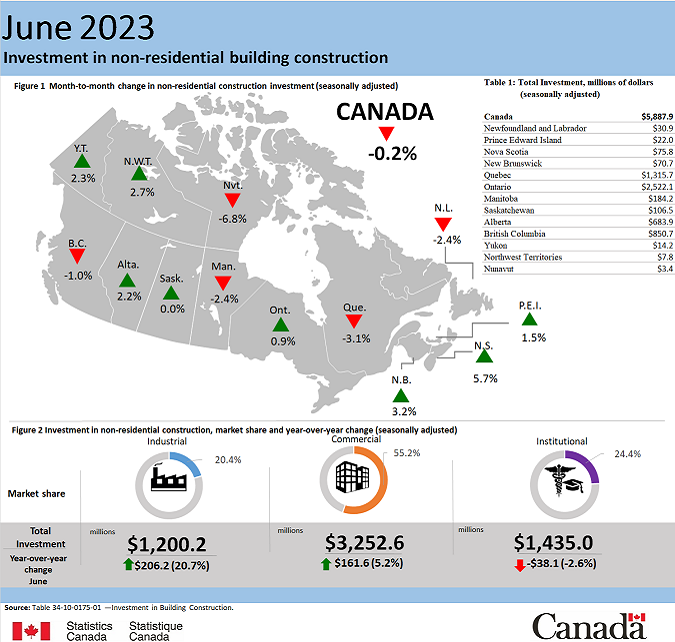

Investment in the non-residential sector edges down

Investment in non-residential construction edged down 0.2% to $5.9 billion in June due to widespread declines in Quebec (-3.1% to $1.3 billion).

Commercial construction was up 0.8% to $3.3 billion in June, while industrial (-1.4% to $1.2 billion) and institutional (-1.4% to $1.4 billion) construction both declined.

Second quarter of 2023 declines due to the residential sector

Overall investment in building construction declined 5.2% to $55.7 billion in the second quarter, entirely due to a drop in residential construction (-8.2% to $37.9 billion). Non-residential construction was up 1.8% to $17.8 billion.

Investment in single-family homes fell 10.5% to $19.7 billion in the second quarter, the largest decline since the second quarter of 2020. Multi-unit construction declined for the third straight quarter, falling 5.7% to $18.2 billion in the second quarter of 2023.

Investment in non-residential construction rose 1.8% to $17.8 billion in the second quarter, the 10th consecutive quarterly increase. Investment in industrial buildings rose 5.6% to $3.7 billion, while commercial construction increased 1.7% to $9.8 billion.

Institutional construction decreased 0.9% to $4.4 billion, with Quebec (-4.6% to $1.3 billion) accounting for most of the decline.

Canadian construction sector shows optimism amidst economic challenges

The Construction Monitor Q2 2023 report by The Royal Institution of Chartered Surveyors (RICS) and the Canadian Institute of Quantity Surveyors (CIQS) revealed the construction sector is demonstrating resilience in an uncertain economic environment.

Some of the key highlights from Construction Monitor Q2 2023 include:

- Workload trend still firm despite broader economic challenges.

- New business enquiries at highest reading in five quarters.

- Infrastructure feedback is particularly strong, while other sectors also remain resilient.

- Skills shortages continue to hinder projects.

The Construction Activity Index edged a little higher from 23% to 28%, fed mostly by infrastructure projects, while skills shortages, such as those across the border in the U.S., continue to stifle activity.

This picture is broadly replicated across the industry apart from the micro sector, but even there, respondents are only slightly less positive than they were in Q1 (22% against 25%). In terms of the regional view, the numbers for Alberta are particularly strong, benefitting from the focus on natural resources; while the results for British Columbia and Quebec remain in a more modest positive territory.

It is clear from the results that the investment programme in infrastructure across the country is gathering pace. The net balance reading for workloads in this area of the industry rose from 34% to 41%, with respondents stating that energy and transport are seeing the strongest growth.

The BOC Fiscal Policy Effect

It appears the industry is confident that the current momentum will continue, although there remains some risk that a mild recession might emerge in the second half of the year. Significantly, the metric capturing new business enquiries jumped to 38% from 21%, which is the best net balance reading in five quarters. This is also reflected in workload expectations for infrastructure over the next twelve months, where the net balance stands at an encouraging 46%. This upbeat mood is also replicated in the results for non-residential workloads (34%) and residential (22%).

The Bank of Canada’s monetary tightening, as seen in many other nations, is causing financial constraints and a somewhat more restrictive lending environment. However, these pressures have been contained for now. While around two-thirds of the respondents report financial constraints as holding back activity—it is the same proportion as the past four quarters.

“With all the talk of inflation, continually rising interest rates, and an expected economic slowdown in the latter half of this year, it was invigorating to read that the workload in the construction sector stands firm, not only in infrastructure but also (more moderately) in the residential and commercial sectors, with an overall positive outlook across Canada,” says Sheila Lennon, CEO of CIQS.