Canadians are sending a message due to increases in grocery prices, which when measured year over year, have outpaced headline consumer inflation since late 2021. While food inflation has eased in recent months—falling out of double-digit territory in March and April 2023—prices for many grocery items have continued to increase month after month and, on balance, are 20% above levels reported two years earlier. During 2022, the sticker shock in grocery aisles became remarkably broad-based, with elevated price growth—year-over-year price increases of 10% or more—affecting a larger share of overall food expenditures. This included spending on many household staples.

Several factors have contributed to the steady acceleration in food prices. As economies emerged from the COVID-19 lockdowns, higher energy prices put upward pressure on costs along the food distribution channel, from planting and harvesting to transporting and selling. Poor growing conditions in Canada and the United States in 2021, rising input and transportation costs, increasing producer prices, supply disruptions, and rising margins at wholesalers and retailers all contributed to the steady increase in food prices. Many of these factors were either stronger than usual or occurring simultaneously, amplifying pressures at different points along the food supply chain. This “Spotlight on data and research” article examines data from recent business and household surveys on how Canadians have been adjusting to higher food prices.

Households are consuming less and changing how and where they shop

Statistics Canada conducted a special household survey in 2022 that asked Canadians how they were coping with higher living costs. During the spring months, before inflation had peaked, nearly three in four Canadians reported that rising prices were affecting their ability to meet day-to-day expenses. For many families, higher food costs were their biggest concern. Two-thirds of Canadians reported that they were very concerned about rising food prices, while 4 out of 10 indicated that, when viewed in relation to price increases in other areas (e.g., shelter and transportation), they were most impacted by higher food costs.

Many households were actively adjusting their purchasing habits as food inflation was ramping up. One-half of respondents reported that they had sought out sales or promotions, while a similar percentage indicated that they had purchased cheaper alternatives, brands or items in response to price pressures.

Consumers have also adjusted how much food they are buying. Data on the volume of food purchases are available from the household expenditure tables, released with quarterly estimates of gross domestic product. These data show that the volume of food products purchased by households rose sharply in the first year of the COVID-19 pandemic, peaking at about 11% above pre-pandemic levels in early 2021, before trending lower as consumers ramped up their spending at restaurants and on other out-of-the-home services as COVID-19 restrictions eased. As of early 2023, household food volumes had declined in six of the past eight quarters (and were unchanged in the remaining two) and were 1.1% above pre-pandemic levels.

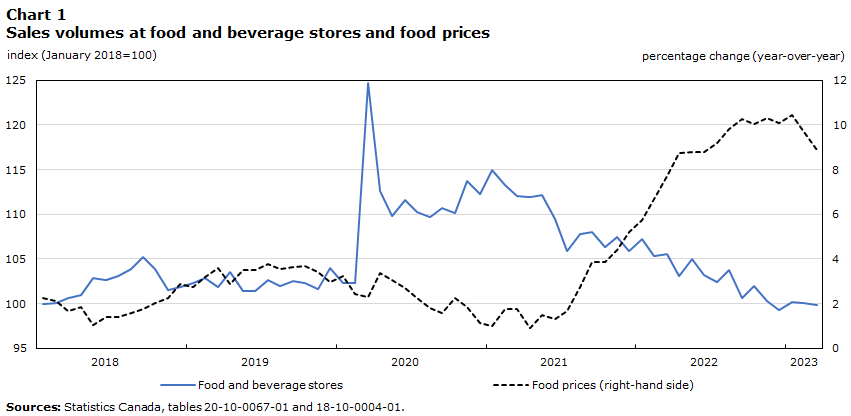

The pullback in food spending as prices increased is clear in the retail sales data from food and beverage stores. Since grocery prices began to increase in early 2021, constant dollar sales—a measure of the volume of sales at food and beverage stores—have trended down (Chart 1). Shoppers are spending more but buying less. In 2022, current dollar sales at food and beverage stores were up 5.8%; when measured on a volume basis, sales were down 3.6%.

Data table for Chart 1

While households may be reducing their food purchases, many are also changing where they are spending their food dollars. Retail industry analysts have documented how purchasing habits have shifted in response to rising prices. A recent survey by Capterra (2023) found that 86% of Canadians surveyed have changed their spending habits, with 71% saying they are either purchasing or using fewer grocery store items than before. Brand and store switching has become prevalent. Retail Insider reported in May 2022 that “over half of shoppers are pivoting to private label brands for fresh and packaged food.” Analysts have also noted that persistently high food inflation has led many consumers to search out lower-cost options, such as discount grocers, to stretch limited food budgets.

Retail Survey of Canadians

Data from the Retail Commodity Survey also suggest that consumers have pivoted away from food and beverage stores to general merchandise stores, a group of retailers that includes warehouse clubs, super-centres and other general merchandise retailers. Before the pandemic, food sales at food and beverage stores accounted for 73.0% of all retail food purchases. This share stood at 74.3% in early 2021, just as food prices began to steadily increase. As prices rose, the share of retail food sales accounted for by food and beverage stores began to decline, falling to about 70% in late 2022. At the same time, the share of food sales at general merchandise stores has risen, increasing from 21.6% in early 2021 to 25.9% in late 2022.

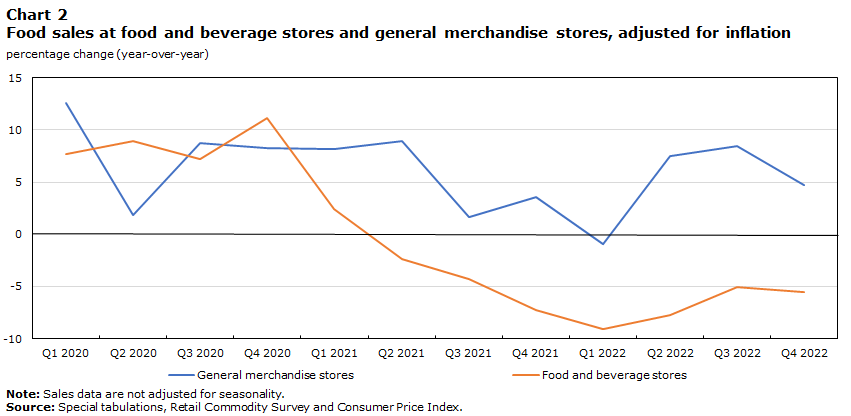

Chart 2 reports on food sales at food and beverage stores and general merchandise stores, adjusted for food price inflation. As the sales data (commodity-level data by store type) are not seasonally adjusted, estimates are presented as year-over-year percentage changes. The volume of food sales at food and beverage stores has declined on a year-over-year basis since the second quarter of 2021. By early 2022, volumes were down 9% from levels observed in early 2021. These declines have continued in recent quarters, but at a more modest pace. In contrast, there have been no similar declines in inflation-adjusted food sales at general merchandise stores, and year-over-year volumes rebounded in 2022.

Data table for Chart 2

The store-specific estimates presented here suggest that many consumers have been switching stores in response to inflationary pressures. Lower sales at food and beverages stores may also partly reflect other emerging trends that are harder to quantify, such as the rising popularity of meal kits delivered to the home, an increased use of coupons, the switch of only certain purchases from one store to another, or a decline in food waste. Additional survey analysis is needed to examine the magnitude of these behavioural changes.