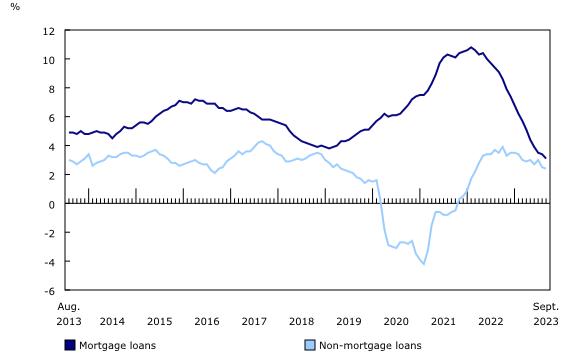

In September, the total credit liabilities of households increased $6.2 billion (+0.2%) to reach $2,881.6 billion. Real estate secured debt, composed of mortgage debt and home equity lines of credit, grew $5.0 billion (+0.2%). Household mortgage debt rose $5.6 billion (+0.3% every month; +3.2% on an annualized basis) in September, a slowdown in growth compared with August.

Non-mortgage loan debt increased $0.6 billion (+0.1%) in September. Every month, outstanding balances on home equity lines of credit decreased $0.6 billion (-0.4%), while credit card debt with chartered banks rose $0.7 billion (+0.7%). The remaining non-mortgage debt categories edged up $0.5 billion (+0.1%).

Private non-financial corporations borrowing

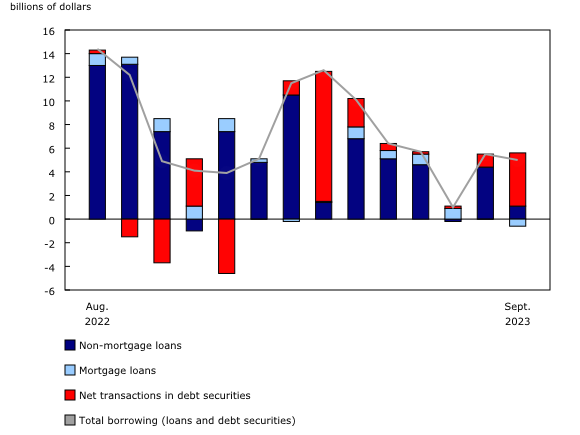

Total credit liabilities of private non-financial corporations increased $6.5 billion (+0.3%) to reach $2,029.3 billion in September. Non-mortgage loans with chartered banks rose $4.2 billion (+0.6%), while non-mortgage loans from government lenders decreased $0.6 billion (-1.1%).

Overall borrowing by private non-financial corporations, composed of the increase in the level of seasonally unadjusted outstanding loans and the net transactions in debt securities, was $5.0 billion in September. Private non-financial corporations recorded net issuances of $4.5 billion in debt securities.

Note to readers

Unless otherwise stated, this article presents data adjusted for seasonality.

Annualized percentage changes shown in this release are calculated by taking the seasonally adjusted value for a given debt item and applying the following formula: (((debt[m]/debt[m-1]) ^ 12 – 1) * 100), where “m” is the reference month.

Revisions

This article on the monthly credit aggregates for September 2023 includes revised estimates from January to August 2023. These data incorporate new and revised data and updated data on seasonal trends.

Overview of the monthly credit aggregates

The monthly credit aggregates break down a portion of the quarterly National Balance Sheet Accounts (NBSA) by month. They provide details on lending to households and non-financial corporations—in other words, the stock of these sectors’ outstanding liabilities from the debtor perspective—across a range of credit instruments, including mortgage loans, non-mortgage loans and debt and equity securities. The aggregates cover all lending sectors, including chartered banks, non-bank deposit-taking institutions, other financial corporations, government and other lenders. The estimates are presented as booked-in-Canada to capture activity within Canada, with either domestic or non-resident lenders. In addition, amounts are reported on an end-of-period basis (i.e., the value of the stock of an asset on the final day of the month). The third month of each quarter is benchmarked to the corresponding quarterly release of the NBSA.

Household borrowing

Household sector borrowing is divided into financing in the form of non-mortgage loans (i.e., funds principally for consumption) and mortgage loans (i.e., debt acquired to finance the purchase of a property, whether residential or non-residential). Household borrowing in the form of mortgage debt and home equity lines of credit is referred to as real estate-secured debt. It presents a further delineation of household liabilities associated with residential and non-residential properties.

As with the household sector, non-financial corporation borrowing is divided into non-mortgage and mortgage loans. However, overall credit liabilities of non-financial corporations also include their borrowing in the form of debt securities, with terms to maturity that are both short-term and long-term in duration.

The NBSA is composed of the balance sheets of all sectors and subsectors of the economy. The main sectors are households, non-profit institutions serving households, financial corporations, non-financial corporations, government and non-residents. The NBSA covers all national non-financial assets and all financial asset-liability claims outstanding in all sectors and, similarly, present stocks at the end of each quarter.